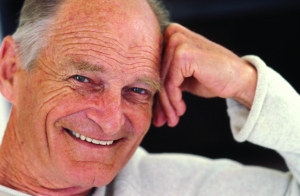

Elder Law Thomas R. Mullen

Americans are living longer than ever before. And while your elderly clients or friends may not want to think about it now, the reality is that many of them will eventually require long-term or nursing home care. In fact, nearly one in two women and one in four men find themselves in nursing homes at some point in their lives. Unfortunately, the high cost of nursing home care is always climbing higher, averaging approximately $9,000 per month in Massachusetts. Worse, Medicare will not pay for it. The result? Most families go broke within the first year due to a prolonged nursing home stay. All the assets saved through a lifetime of hard work—gone.

Americans are living longer than ever before. And while your elderly clients or friends may not want to think about it now, the reality is that many of them will eventually require long-term or nursing home care. In fact, nearly one in two women and one in four men find themselves in nursing homes at some point in their lives. Unfortunately, the high cost of nursing home care is always climbing higher, averaging approximately $9,000 per month in Massachusetts. Worse, Medicare will not pay for it. The result? Most families go broke within the first year due to a prolonged nursing home stay. All the assets saved through a lifetime of hard work—gone.

Attorney Tom Mullen can usually help your clients or friends qualify for assistance from Medicaid, without “spending down” most, if not all, of their hard earned savings. Most seniors are completely unaware of this option, and it is the reason Thomas R. Mullen has dedicated himself to Medicaid planning. He has nearly 20 years of experience using legal techniques and strategies that allow a senior’s nursing home stay to be covered by Medicaid, while still keeping their home and many of their assets. For married couples, Tom can reduce the privately funded portion of a nursing home stay from an average of $9,000 to $1,500 per month — often less — even if one of them is already in a nursing home. And if you are not in a nursing home, you can still give money away despite what well-intentioned professionals may tell you.

The bottom line is this: Medicaid planning is legal, moral and ethical. Our seniors have earned the right—they deserve the right—to pass on a modest inheritance to their children.

Thomas Mullen Attorney Treatment Of Income

The basic Medicaid rule for nursing home residents is that they must pay all of their income to the nursing home. The resident may retain only a minimal $70 monthly personal needs llowance. If married, the well spouse is entitled to a shelter allowance. In order to compute the allowance, the Commonwealth requires the actual expenses for either rent or mortgage (including interest and principle), property taxes and homeowner’s (or renter’s) insurance, and any required maintenance charge for a condominium. The cost of heat must also be taken into account. Therefore, in the case of a married applicant, the community spouse who continues to live at home is entitled to retain approximately $1,800 (this can be increased to approximately $2,500 per month) to bring the community spouse to the Commonwealth’s minimum monthly maintenance needs allowance (MMMNA).

The basic Medicaid rule for nursing home residents is that they must pay all of their income to the nursing home. The resident may retain only a minimal $70 monthly personal needs llowance. If married, the well spouse is entitled to a shelter allowance. In order to compute the allowance, the Commonwealth requires the actual expenses for either rent or mortgage (including interest and principle), property taxes and homeowner’s (or renter’s) insurance, and any required maintenance charge for a condominium. The cost of heat must also be taken into account. Therefore, in the case of a married applicant, the community spouse who continues to live at home is entitled to retain approximately $1,800 (this can be increased to approximately $2,500 per month) to bring the community spouse to the Commonwealth’s minimum monthly maintenance needs allowance (MMMNA).

For Medicaid applicants who are married, it is crucial to understand that the income of the community spouse is not at risk. The income of the community spouse is not counted in determining the Medicaid applicant’s eligibility. Only income in the applicant’s name is counted in determining his or her eligibility. Thus, even if the community spouse is still working and earning $5,000 a month, he will not have to contribute to the cost of caring for his spouse in a nursing home.